HMRC are making some changes in January 2015 which affects the sale of digital services.

Merchants who sell digital services via their website should keep abreast of the latest rules on ebook VAT in various EU states - see http://www.vatlive.com/european-news...book-vat-22-4/ for more details.

The generic instructions below explain the process of configuring a SellerDeck site to charge VAT based the shopper’s country for digital services (Digital download).

Note: The following instructions will only work with “Product Prices Entered” set to “Exclusive of Tax”.

Note: “Tax by location” also needs to be set to “Tax by delivery address”

How to configure the tax settings in SellerDeck:

How to configure the tax treatment for products:

Your site will now be configured to charge VAT based on the country the shopper is ordering from for Digital downloads, but not for non-digital download products.

SellerDeck Link for Sage 50 configuration

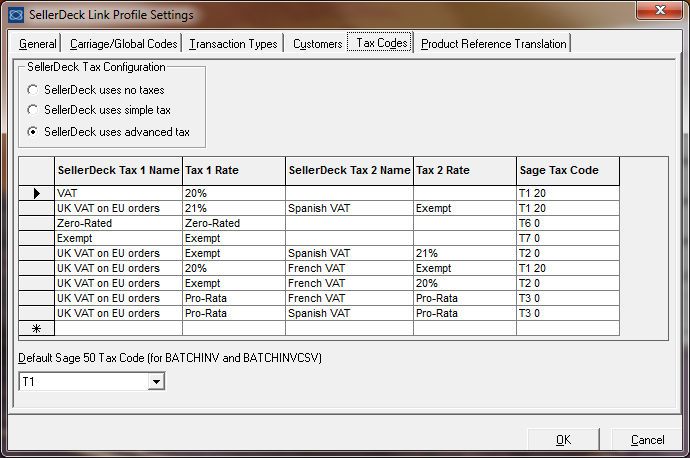

If you are also using SellerDeck Link for Sage 50, below is a screenshot to illustrate how you would configure it, based on the generic example given above.

Limitations:

-With this configuration, you cannot charge shipping on digital goods.

-With this configuration, it is recommended to use Pro-Rata shipping. Pro-Rata must be used if you are shipping digital and physical goods.

-With this configuration, if you are also using SellerDeck Link for Sage 50, you cannot sell digital goods and physical products in the same order.

Merchants who sell digital services via their website should keep abreast of the latest rules on ebook VAT in various EU states - see http://www.vatlive.com/european-news...book-vat-22-4/ for more details.

The generic instructions below explain the process of configuring a SellerDeck site to charge VAT based the shopper’s country for digital services (Digital download).

Note: The following instructions will only work with “Product Prices Entered” set to “Exclusive of Tax”.

Note: “Tax by location” also needs to be set to “Tax by delivery address”

How to configure the tax settings in SellerDeck:

- In SellerDeck, go to Settings | Business settings | Tax.

- In the “Taxes” grid in the top left corner a new tax needs to be entered for each EU country. For example:

French VAT

Spanish VAT

- Click “Apply”.

- For each new tax, “Tax rate for:” needs to be edited to reflect the VAT rate of that country. For example:

French VAT 20.00

Spanish VAT 21.00

- Click “Apply”.

- In Addition to adding a new Tax for each EU country, you need to create a new Tax called “UK VAT on EU orders” and set the “Tax rate for:” to 20.00.

UK VAT on EU orders 20.00

- Click ”Apply”.

- Under “Tax by location” you will need to double click on “EU Tax zone” and remove the EU countries from the list of “Zone members” by clicking on each country, for example France and Spain, then clicking “>”.

- Click “OK” when done.

- Under “Tax zones” a new zone needs to be created for each EU country, for example, France and Spain. Click “Add zone”, name the zone by the name of the country, for example “France”, then add that country to the Zone members by clicking on the country and clicking “<”.

- Click “OK” when done.

- In “Tax zones”, click on one of the countries, for example “France”. Under “Taxes Levied in France Zone” select the following:

Tax 1: UK VAT on EU orders

Tax 2: French VAT

- Repeat this for each EU country.

- Click on the "Shipping and handling" tab (Within Business settings).

- If "Shipping charges made" is ticked, change the "Tax Rate" to "Pro-Rata" for each rate in the shipping taxes grid in the top left corner.

How to configure the tax treatment for products:

- In SellerDeck, click on a digital download product in the content tree.

- Click on the “Details” tab

- In “Tax treatment”, for UK tax and all EU countries, select your normal tax rate which may be “VAT".

- For “UK VAT on EU orders” select “Exempt”.

- In SellerDeck, click on a non-digital download product in the content tree.

- Click on the “Details” tab

- In “Tax treatment” for UK tax, select your normal tax rate which may be “VAT.

- In “Tax treatment” for EU countries, select “Exempt”.

- For “UK VAT on EU orders” select “Standard”.

Your site will now be configured to charge VAT based on the country the shopper is ordering from for Digital downloads, but not for non-digital download products.

SellerDeck Link for Sage 50 configuration

If you are also using SellerDeck Link for Sage 50, below is a screenshot to illustrate how you would configure it, based on the generic example given above.

Limitations:

-With this configuration, you cannot charge shipping on digital goods.

-With this configuration, it is recommended to use Pro-Rata shipping. Pro-Rata must be used if you are shipping digital and physical goods.

-With this configuration, if you are also using SellerDeck Link for Sage 50, you cannot sell digital goods and physical products in the same order.