As from the 1st of January 2010, the standard rate of VAT will increase to 17.5% from the current 15.0% rate.

These instructions cover both ‘Simple’ and ‘Advanced’ tax setups. Please note that this document refers to version 8 and version 9 only. Use on earlier versions is at your own risk.

Warning: SellerDeck recommend that before following these instructions you take a Snapshot of your site and back up your SellerDeck Site folder

Invoiced orders and orders shipped before 1st January must remain at the old rate of 15.0%. To prevent accidental VAT changes to these orders you will need to take the following steps:

(Please note if your Shipping uses Standard VAT, the SQL will not fully protect your orders and the VAT on shipping will change if the order detail is edited. The default Shipping VAT is Pro-Rata.)

PLEASE NOTE: SellerDeck must be installed for the SQL runner tool to operate. Additionally SellerDeck and any plugins that might be using the database must closed prior to running the SQL runner tool.

For Merchants using the Simple Tax Settings

Note: If you are using ‘Simple Tax with’ ‘Tax Inclusive Pricing’, you may get a warning regarding ‘Pro Rata Shipping’ is not allowed. If this is the case, switch to the ‘Shipping’ pane, and select the level of tax you previously had applied to shipping whilst tax was in ‘Simple Mode’. If you had ‘VAT’ selected whilst in ‘Simple Mode’, then choose ‘VAT 15% Rate’ when switching Tax to ‘Advanced Mode’.

For Merchants using the Advanced Tax settings

You can apply the following if you used the KB article http://kb.sellerdeck.com/activekb/questions/1415/ to implement the 15% rate.

For Merchants using the Advanced Tax settings who have edited the tax rate manually

Additional Notes for SellerDeck Enterprise SQL Users

If your store is using SellerDeck Enterprise with a SQL database, the operation of the ‘ActSqlRunner.exe’ is slightly different. However the remainder of the instructions for both ‘Simple’ and ‘Advanced’ tax remain the same.

PLEASE NOTE: If you are using Sage accounting software you will need to transfer any outstanding orders *before* running either of the SQL queries described above.

This article is provided in good faith for the assistance of SellerDeck users. The information in it is correct to the best of our knowledge, but SellerDeck does not warrant or guarantee the information provided and cannot accept responsibility for any inaccuracy. It does not constitute general tax advice or guidance. It is your responsibility to assure yourself that your business practices conform to all mandatory regulations and requirements.

These instructions cover both ‘Simple’ and ‘Advanced’ tax setups. Please note that this document refers to version 8 and version 9 only. Use on earlier versions is at your own risk.

Warning: SellerDeck recommend that before following these instructions you take a Snapshot of your site and back up your SellerDeck Site folder

Invoiced orders and orders shipped before 1st January must remain at the old rate of 15.0%. To prevent accidental VAT changes to these orders you will need to take the following steps:

(Please note if your Shipping uses Standard VAT, the SQL will not fully protect your orders and the VAT on shipping will change if the order detail is edited. The default Shipping VAT is Pro-Rata.)

PLEASE NOTE: SellerDeck must be installed for the SQL runner tool to operate. Additionally SellerDeck and any plugins that might be using the database must closed prior to running the SQL runner tool.

For Merchants using the Simple Tax Settings

- Download the SQL Runner tool from http://www.sellerdeck.co.uk/support-files/VAT2010.zip and then extract it to your desktop using WinZip or similar

- Suspend the store as late as possible before 1 January 2010 by going to ‘Settings | Business Settings | Ordering’, check ‘Suspended’ and uncheck ‘Allowed’ under the ‘Online Ordering’ group, apply your changes and then click ‘Publish to Web’

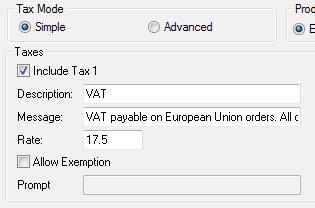

- Open ‘Settings | Business Settings | Tax'

- Select ‘Advanced Tax’ under the ‘Tax Mode’ group

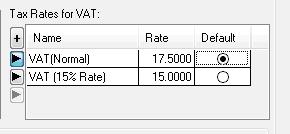

- If there is not already a Tax Rate for 15% then add a new rate of 15% by clicking the ‘+’ in the ‘Tax Rates for VAT’ panel, give it a name such as ‘VAT (15%)’and enter ‘15’ into the ‘Rate’ field for the new rate that has just been added. It does not matter which tax you set as default as you will be switching back to ‘Simple Tax’ later

__________________________________________________

Note: If you are using ‘Simple Tax with’ ‘Tax Inclusive Pricing’, you may get a warning regarding ‘Pro Rata Shipping’ is not allowed. If this is the case, switch to the ‘Shipping’ pane, and select the level of tax you previously had applied to shipping whilst tax was in ‘Simple Mode’. If you had ‘VAT’ selected whilst in ‘Simple Mode’, then choose ‘VAT 15% Rate’ when switching Tax to ‘Advanced Mode’.

__________________________________________________

- Click ‘OK’, to save the changes, then close SellerDeck and any plugin that may be using the database

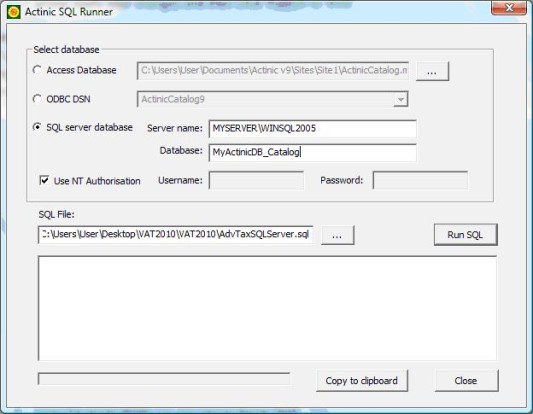

- Open ActSqlRunner.exe by double clicking on it (SellerDeck Enterprise SQL Users please see the section at the end of this article)

- Make sure the ‘Access Database’ radio button is selected, click the ‘…’ next to the ‘Access Database’ field and browse to your SellerDeck site folder, which by default is located within ‘My Documents\Actinic Vx\Sites\SiteName’, and select ActinicCatalog.mdb’

- NOTE: We recommend that you do not use the ODBC function

- Click the ‘…’ next to the ‘SQL File’ field and locate ‘SimpleTax.sql’. It will be in the same folder as the ‘ActSqlRunner.exe’

- Click ‘Run SQL’ to update your store database

- Open SellerDeck, then go to ‘Settings | Business Settings | Tax’, reselect ‘Simple’ under the ‘Tax Mode’ group, and enter ’17.5’ into the ‘Rate’ field. Click ‘OK’ to close ‘Business Settings’ and to save the changes

- Update the site by clicking ‘Publish to Web’

- Unsuspend the store on or after 1 January 2010 by going to ‘Settings | Business Settings | Ordering’, check ‘Allowed’ and uncheck ‘Suspended’ under the ‘Online Ordering’ group, apply your changes and then click ‘Publish to Web’

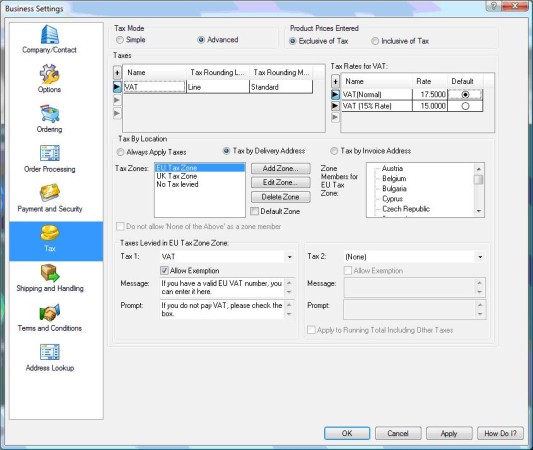

For Merchants using the Advanced Tax settings

You can apply the following if you used the KB article http://kb.sellerdeck.com/activekb/questions/1415/ to implement the 15% rate.

- Download the SQL Runner tool from http://downloads.sellerdeck.com/VAT2010.zip and then extract it to your desktop using WinZip or similar

- Suspend the store as late as possible before 1 January 2010 by going to ‘Settings | Business Settings | Ordering’, check ‘Suspended’ and uncheck ‘Allowed’ under the ‘Online Ordering’ group, apply your changes and then click ‘Publish to Web’

- Go to ‘Settings | Business Settings | Tax’

- Set the old Tax Rate of 17.5% as the default within the ‘Tax Rates for VAT’ group. Click ‘OK’

- Close SellerDeck and any plugin that may be using the database. We are now going to update the vatable products from ‘15%’ to ‘17.5%’. Products that you have set to use ‘Custom Tax’ will need to be updated manually within SellerDeck after the sql runner has completed

- Open ActSqlRunner.exe by double clicking on it. (SellerDeck Enterprise SQL Users please see the section at the end of this article)

- Make sure the ‘Access Database’ radio button is selected, click the ‘…’ next to the ‘Access Database’ field and browse to your SellerDeck site folder, which by default is located within ‘My Documents\Actinic Vx\Sites\SiteName’, and select ActinicCatalog.mdb’

- NOTE: We recommend that you do not use the ODBC function

- Click the ‘…’ next to the ‘SQL File’ field and locate ‘AdvTax.sql’. It will be in the same folder as the ‘ActSqlRunner.exe’

- Click ‘Run SQL’ to update your store database

- Open SellerDeck

- Update the site by clicking ‘Publish to Web’

- Unsuspend the store on or after 1 January 2010 by going to ‘Settings | Business Settings | Ordering’, check ‘Allowed’ and uncheck ‘Suspended’ under the ‘Online Ordering’ group, apply your changes and then click ‘Publish to Web’

For Merchants using the Advanced Tax settings who have edited the tax rate manually

- Download the SQL Runner tool from http://www.sellerdeck.co.uk/support-files/VAT2010.zip and then extract it to your desktop using WinZip or similar

- Suspend the store as late as possible before 1 January 2010 by going to ‘Settings | Business Settings | Ordering’, check ‘Suspended’ and uncheck ‘Allowed’ under the ‘Online Ordering’ group, apply your changes and then click ‘Publish to Web’

- Go to ‘Settings | Business Settings | Tax’

- Click the ‘+’ in the ‘Tax Rates for VAT’ panel, give it a name such as ‘VAT (17.5%)’and enter ‘17.5’ into the ‘Rate’ field for the new rate that has just been added.

- Select this as 'Default' and click 'OK'.

- Close SellerDeck and any plugin that may be using the database.

- Open ActSqlRunner.exe by double clicking on it.

- Make sure the ‘Access Database’ radio button is selected, click the ‘…’ next to the ‘Access Database’ field and browse to your SellerDeck site folder, which by default is located within ‘My Documents\Actinic Vx\Sites\SiteName’, and select ActinicCatalog.mdb’

- NOTE: We recommend that you do not use the ODBC function

- Click the ‘…’ next to the ‘SQL File’ field and locate ‘AdvTax.sql’. It will be in the same folder as the ‘ActSqlRunner.exe’

- Click ‘Run SQL’ to update your store database

- Open SellerDeck

- Update the site by clicking ‘Publish to Web’

- Unsuspend the store on or after 1 January 2010 by going to ‘Settings | Business Settings | Ordering’, check ‘Allowed’ and uncheck ‘Suspended’ under the ‘Online Ordering’ group, apply your changes and then click ‘Publish to Web’

Additional Notes for SellerDeck Enterprise SQL Users

If your store is using SellerDeck Enterprise with a SQL database, the operation of the ‘ActSqlRunner.exe’ is slightly different. However the remainder of the instructions for both ‘Simple’ and ‘Advanced’ tax remain the same.

- Make sure SellerDeck and any plugin that uses the database, is closed and you have taken both a snapshot, and you have backed up your main SellerDeck database on the SQL server

- Select the ‘SQL server database’ radio button

- Enter the server details into the ‘Server Name’ field

- Enter the name of your main SellerDeck database into the ‘Database:’ field

- If you connect to your database using Windows authentication, select ‘Use NT Authorisation’, if not uncheck in and enter your SQL server admin Username and Password

- Next browse to the SQL File, the file you select will depend on whether your store is setup to use ‘Simple’ or ‘Advanced’ tax:

- If using Simple Tax, browse to ‘SimpleTaxSQLServer.sql’

- If using Advanced Tax, browse to ‘AdvTaxSQLServer.sql’

- Now click ‘Run SQL’

- Continue the process for either ‘Simple Tax’ or ‘Advanced Tax’ above

PLEASE NOTE: If you are using Sage accounting software you will need to transfer any outstanding orders *before* running either of the SQL queries described above.

This article is provided in good faith for the assistance of SellerDeck users. The information in it is correct to the best of our knowledge, but SellerDeck does not warrant or guarantee the information provided and cannot accept responsibility for any inaccuracy. It does not constitute general tax advice or guidance. It is your responsibility to assure yourself that your business practices conform to all mandatory regulations and requirements.