When registering with HSBC (or any other Payment Service Provider for that matter), ensure that they know you are using SellerDeck so they can provide you with the right information to enter into the software as our integration with them may use a different gateway to their standard offering.

To set up HSBC within SellerDeck:

* go to the 'Settings | Business Settings | Payment and Security' panel

* click the '+' in the top left corner of the grid to add a new payment method

* click on the drop-down box under the 'Payment Method' column and select 'HSBC Secure ePayments'

* then click on the 'Configure Method' button

* enter the 'Storefront ID' and 'CPI Hash' given to you by HSBC

* set whether you want the store to run in test mode (no money is taken from the credit card) or production mode (this is using it live)

* also set if you want to 'charge transactions immediately' (take the money straight from the card straight away) or 'Pre-authorise transactions' (money is not taken until you authorise the payment to be taken via your HSBC virtual terminal)

* click 'OK'

* click 'OK' again on the 'Payment and Security' window

* update your site.

Notes regarding the integration:

* HSBC require that the call to their secure servers comes from a secure site (i.e. the URL contains 'https://'). So that you don't have to have a secure site the integration has been created so that your customers are bounced to SellerDeck's secure servers (also known as intermediate servers) before being bounced over to HSBC.

* The customer's address details will not be passed into HSBC if you are using simple tax calculations and simple shipping calculations. This is because HSBC requires a country code (provided by advanced shipping and tax calculation in SellerDeck) in order to display address information correctly.

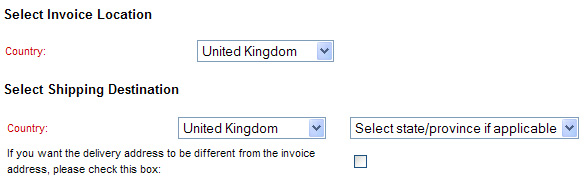

* If you allow customers to have goods shipped to a location different to the invoice address then you must set your 'Tax by Location' basis to 'Tax by invoice address' (Business Settings | Tax):

This means that you will have drop-down boxes for both the invoice address and delivery address countries on the first checkout page and in turn this will convert the country selected from the list to the correct ISO code when passed to HSBC:

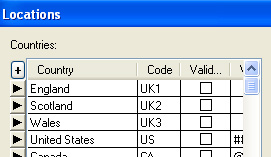

If you want to set areas of the UK as countries in 'Settings | Locations' (e.g. England, Scotland, Wales etc) so that you can charge shipping accordingly then you should set the 'code' fields as 'UK1', 'UK2', 'UK3' etc as only the first two characters are used but SellerDeck requires unique codes.

To set up HSBC within SellerDeck:

* go to the 'Settings | Business Settings | Payment and Security' panel

* click the '+' in the top left corner of the grid to add a new payment method

* click on the drop-down box under the 'Payment Method' column and select 'HSBC Secure ePayments'

* then click on the 'Configure Method' button

* enter the 'Storefront ID' and 'CPI Hash' given to you by HSBC

* set whether you want the store to run in test mode (no money is taken from the credit card) or production mode (this is using it live)

* also set if you want to 'charge transactions immediately' (take the money straight from the card straight away) or 'Pre-authorise transactions' (money is not taken until you authorise the payment to be taken via your HSBC virtual terminal)

* click 'OK'

* click 'OK' again on the 'Payment and Security' window

* update your site.

Notes regarding the integration:

* HSBC require that the call to their secure servers comes from a secure site (i.e. the URL contains 'https://'). So that you don't have to have a secure site the integration has been created so that your customers are bounced to SellerDeck's secure servers (also known as intermediate servers) before being bounced over to HSBC.

* The customer's address details will not be passed into HSBC if you are using simple tax calculations and simple shipping calculations. This is because HSBC requires a country code (provided by advanced shipping and tax calculation in SellerDeck) in order to display address information correctly.

* If you allow customers to have goods shipped to a location different to the invoice address then you must set your 'Tax by Location' basis to 'Tax by invoice address' (Business Settings | Tax):

This means that you will have drop-down boxes for both the invoice address and delivery address countries on the first checkout page and in turn this will convert the country selected from the list to the correct ISO code when passed to HSBC:

If you want to set areas of the UK as countries in 'Settings | Locations' (e.g. England, Scotland, Wales etc) so that you can charge shipping accordingly then you should set the 'code' fields as 'UK1', 'UK2', 'UK3' etc as only the first two characters are used but SellerDeck requires unique codes.