Warning: SellerDeck recommend that before following these instructions you take a Snapshot of your site and back up your SellerDeck Site folder

To implement the new 15% VAT rate:

Invoiced orders and orders shipped before 14 November must remain at the old rate of 17.5%. To prevent accidental VAT changes to these orders you will need to take the following steps:

WARNING: Any orders edited before or without completing the following steps will have the tax rate changed incorrectly.

(Please note if your Shipping uses Standard VAT, the SQL will not fully protect your orders and the VAT on shipping will change if the order detail is edited. The default Shipping VAT is Pro-Rata.)

To apply the ‘VAT (17.5)’ rate to the orders follow these instructions:

SQL For Advanced Tax users:

UPDATE TaxBands

INNER JOIN TaxBands AS TaxBands_1

ON TaxBands.nTaxID = TaxBands_1.nTaxID,

[Order] INNER JOIN OrderDetail

ON Order.[Order Sequence Number] = OrderDetail.OrderSequenceNumber

SET OrderDetail.sTax1OpaqueData = [TaxBands_1].[nBandID] & '=' & 100*([TaxBands_1].[dBandRate]) & '=0=' & [TaxBands_1].[sBandName] & '='

WHERE (((TaxBands.dBandRate)=15)

AND ((TaxBands_1.dBandRate)=17.5)

AND ((TaxBands.bDefault)=1)

AND ((TaxBands_1.bDefault)=0)

AND ((Order.[Date Ordered])<"2008/12/01")

AND (([TaxBands].[nBandID] & '=' & 100*([TaxBands_1].[dBandRate]) & '=0=' & [TaxBands].[sBandName] & '=')=[OrderDetail].[sTax1OpaqueData]))

OR (((TaxBands.dBandRate)=15)

AND ((TaxBands_1.dBandRate)=17.5)

AND ((TaxBands.bDefault)=1)

AND ((TaxBands_1.bDefault)=0)

AND (([TaxBands].[nBandID] & '=' & 100*([TaxBands_1].[dBandRate]) & '.00=0=' & [TaxBands].[sBandName] & '=')=[OrderDetail].[sTax1OpaqueData])

AND ((Order.[Date Ordered])<"2008/12/01"));

For Simple Tax users who switched Advanced Tax on in the course of these instructions:

UPDATE TaxBands

INNER JOIN TaxBands AS TaxBands_1

ON TaxBands.nTaxID = TaxBands_1.nTaxID,

[Order] INNER JOIN OrderDetail

ON Order.[Order Sequence Number] = OrderDetail.OrderSequenceNumber

SET OrderDetail.sTax1OpaqueData = [TaxBands_1].[nBandID] & '=' & 100*([TaxBands_1].[dBandRate]) & '=0=VAT='

WHERE (((TaxBands.dBandRate)=15)

AND ((TaxBands_1.dBandRate)=17.5)

AND ((TaxBands.bDefault)=1)

AND ((TaxBands_1.bDefault)=0)

AND (('101=' & 100*([TaxBands_1].[dBandRate]) & '=0=VAT=')=[OrderDetail].[sTax1OpaqueData])

AND ((Order.[Date Ordered])<"2008/12/01"))

OR (((TaxBands.dBandRate)=15)

AND ((TaxBands_1.dBandRate)=17.5)

AND ((TaxBands.bDefault)=1)

AND ((TaxBands_1.bDefault)=0)

AND (('101=' & 100*([TaxBands_1].[dBandRate]) & '.00=0=VAT=')=[OrderDetail].[sTax1OpaqueData])

AND ((Order.[Date Ordered])<"2008/12/01"));

To implement the new 15% VAT rate:

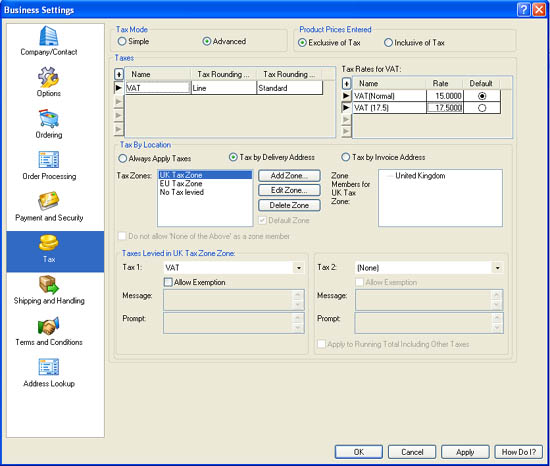

- Open the ‘Business Settings’ menu

- Click the ‘Tax’ tab

- If using 'Simple' tax, switch to 'Advanced', you can switch it back later

- In the ‘Tax Rates for VAT’ panel, change the original VAT rate from 17.5000 to 15

- Click ‘OK’

- At this stage you will need to update manually any Custom tax that you have set up

- If you were originally using Simple Tax, you can switch back to it now

- In the ‘Ordering’ tab of ‘Business Settings’ UNtick ‘Suspended’ in the ‘Ordering Options on Web Site’ panel

- Update the web site

- If you want to apply the new VAT rate to an existing order; edit each order line of each order and click OK. This will automatically recalculate the VAT on the order.

Invoiced orders and orders shipped before 14 November must remain at the old rate of 17.5%. To prevent accidental VAT changes to these orders you will need to take the following steps:

WARNING: Any orders edited before or without completing the following steps will have the tax rate changed incorrectly.

(Please note if your Shipping uses Standard VAT, the SQL will not fully protect your orders and the VAT on shipping will change if the order detail is edited. The default Shipping VAT is Pro-Rata.)

- First take a Snapshot of your site and back up your SellerDeck Site folder

- Next, in the ‘Ordering’ tab of ‘Business Settings’ tick ‘Suspended’ in the ‘Ordering Options on Web Site’ panel

- Click ‘OK’ and Update the site to suspend ordering

- In the ‘Tax Mode’ panel, make sure ‘Advanced’ is selected. You can switch back to Simple Tax at the end of the process.

- In the ‘Taxes’ panel of the ‘Tax’ tab in ‘Business Settings’, select the VAT line

- In the ‘Tax Rates for VAT’ panel click ‘+’ to add a new rate

- Give the rate a name such as ‘VAT (17.5)’ and set the rate to 17.5

- Click 'OK'

To apply the ‘VAT (17.5)’ rate to the orders follow these instructions:

- Close SellerDeck

- Open Windows Explorer

- Browse to your SellerDeck Site folder

- To open ‘ActinicCatalog.mdb’ in Access, right click on it and select ‘Open with’, then ‘Microsoft Access' If you are unable to run the SQL query, you must avoid editing orders for which you received payment before 1st December.

- In Access go to the 'View’ menu and select ‘Database Objects’, then ‘Queries’

- Click 'New'

- Select 'Design' view

- Click 'Close' on the 'Show Table' window

- Go to 'View’, then ‘SQL view' (in Access 2007, click 'Query Design' in the 'Create' ribbon; click 'Close'; right-click in the blank 'Queryx' window and select 'SQL View')

- Copy and paste one of the SQL statements below into the page, depending whether you have been using Simple or Advanced Tax; replacing ‘SELECT;’ if that is already there:

SQL For Advanced Tax users:

UPDATE TaxBands

INNER JOIN TaxBands AS TaxBands_1

ON TaxBands.nTaxID = TaxBands_1.nTaxID,

[Order] INNER JOIN OrderDetail

ON Order.[Order Sequence Number] = OrderDetail.OrderSequenceNumber

SET OrderDetail.sTax1OpaqueData = [TaxBands_1].[nBandID] & '=' & 100*([TaxBands_1].[dBandRate]) & '=0=' & [TaxBands_1].[sBandName] & '='

WHERE (((TaxBands.dBandRate)=15)

AND ((TaxBands_1.dBandRate)=17.5)

AND ((TaxBands.bDefault)=1)

AND ((TaxBands_1.bDefault)=0)

AND ((Order.[Date Ordered])<"2008/12/01")

AND (([TaxBands].[nBandID] & '=' & 100*([TaxBands_1].[dBandRate]) & '=0=' & [TaxBands].[sBandName] & '=')=[OrderDetail].[sTax1OpaqueData]))

OR (((TaxBands.dBandRate)=15)

AND ((TaxBands_1.dBandRate)=17.5)

AND ((TaxBands.bDefault)=1)

AND ((TaxBands_1.bDefault)=0)

AND (([TaxBands].[nBandID] & '=' & 100*([TaxBands_1].[dBandRate]) & '.00=0=' & [TaxBands].[sBandName] & '=')=[OrderDetail].[sTax1OpaqueData])

AND ((Order.[Date Ordered])<"2008/12/01"));

For Simple Tax users who switched Advanced Tax on in the course of these instructions:

UPDATE TaxBands

INNER JOIN TaxBands AS TaxBands_1

ON TaxBands.nTaxID = TaxBands_1.nTaxID,

[Order] INNER JOIN OrderDetail

ON Order.[Order Sequence Number] = OrderDetail.OrderSequenceNumber

SET OrderDetail.sTax1OpaqueData = [TaxBands_1].[nBandID] & '=' & 100*([TaxBands_1].[dBandRate]) & '=0=VAT='

WHERE (((TaxBands.dBandRate)=15)

AND ((TaxBands_1.dBandRate)=17.5)

AND ((TaxBands.bDefault)=1)

AND ((TaxBands_1.bDefault)=0)

AND (('101=' & 100*([TaxBands_1].[dBandRate]) & '=0=VAT=')=[OrderDetail].[sTax1OpaqueData])

AND ((Order.[Date Ordered])<"2008/12/01"))

OR (((TaxBands.dBandRate)=15)

AND ((TaxBands_1.dBandRate)=17.5)

AND ((TaxBands.bDefault)=1)

AND ((TaxBands_1.bDefault)=0)

AND (('101=' & 100*([TaxBands_1].[dBandRate]) & '.00=0=VAT=')=[OrderDetail].[sTax1OpaqueData])

AND ((Order.[Date Ordered])<"2008/12/01"));

- Go to the 'Query' menu and click 'Run'

- Close Access

- Open SellerDeck and retrieve orders.